Yet, when the dust settled, markets clawed back those losses to finish October up 2.1%, approaching all-time highs that were buoyed by stellar corporate earnings and resilient economic data.

Sure, there are items on the “wall of worry.” The health of the U.S. labor market remains front and center, valuations deserve a thoughtful look and Federal Reserve policy could still surprise. But there’s also plenty to like: a strong third-quarter earnings season, a boom in artificial intelligence (AI) investment, solid economic expansion, a more accommodative Fed and healthy credit spreads.

In other words, while turbulence persists, the flight path remains constructive.

The Fed and labor market

Job growth has clearly slowed and nearly stalled. The U.S. economy added only 22,000 jobs in August, and with the Bureau of Labor Statistics (BLS) shuttered as part of the broader government shutdown, official September data is unavailable.1 The ADP private payroll estimate suggested a decline of roughly 32,000 jobs, though that dataset tends to be less reliable given its narrower industry coverage.2

Despite the weak headline figures, the labor market’s underlying tone remains healthy. Unemployment claims are still low, unit labor costs are easing and real wages continue to rise at a sustainable pace. Together, these indicators suggest that while hiring momentum has cooled, employers are largely retaining workers and productivity improvements are helping maintain profit margins.

This mix of data provides cover for the Fed to continue its gradual shift toward easier policy, just as it did with its October rate cut. The Fed’s latest commentary signaled a preference for moderation, aiming to balance support for growth with vigilance on inflation. In our view, this data-dependent and measured approach helps sustain the current economic expansion without reigniting inflationary pressures.

Are we in an artificial intelligence bubble?

With the S&P 500 hovering near all-time highs and “bubble territory” warnings flashing across CNBC and Bloomberg, it’s a fair question. Our answer: No, we do not believe we’re in a bubble. That’s not a casual opinion—it’s grounded in data and historical precedent.

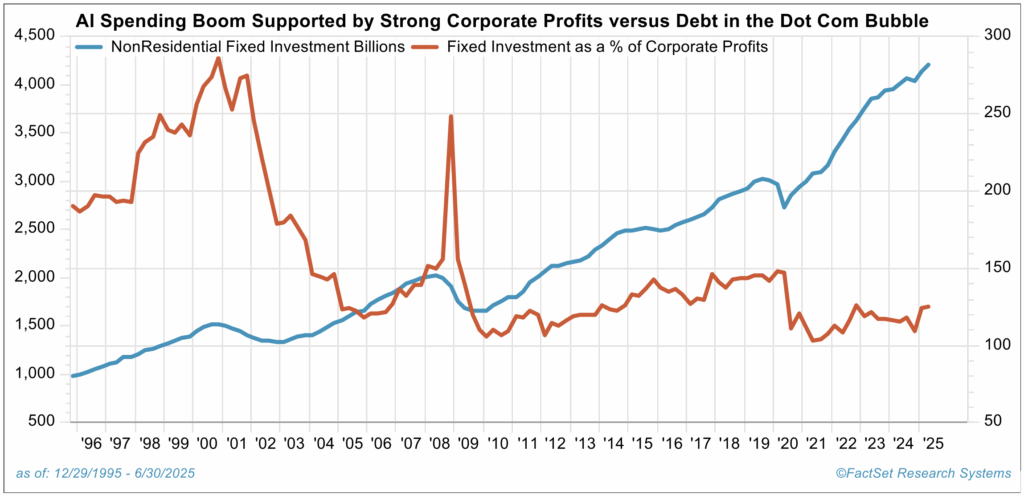

The first and most important question is whether the AI spending surge is sustainable. Unlike prior investment booms that were debt-fueled, today’s capital expenditure (capex) wave is being financed by earnings and cash flows.

The chart below helps illustrate this: The blue line tracks Non-Residential Fixed Investment, essentially business spending, which has moved steadily higher over time and accelerated in recent years. The orange line depicts non-residential fixed investment as a percentage of corporate profits. The higher that ratio climbs, the less sustainable the how.

In prior bubbles, this ratio spiked as companies borrowed to chase growth. Today, it remains comfortably grounded, a clear indication that this AI-driven capex cycle is being funded responsibly.

Source: FactSet

We’ve received several questions about the circular nature of some of the large, headline-grabbing AI investments—specifically, whether certain deals feel reminiscent of the tech bubble era. While we acknowledge the degree of interconnectedness in today’s AI ecosystem, we would stop well short of drawing direct parallels to the late 1990s.

Many of the infamous tech boom transactions, such as vendor financing arrangements and capacity swaps were, in hindsight, little more than fabricated demand and accounting fiction. By contrast, today’s AI-related deals are disclosable, contractual and typically involve large, profitable counterparties with robust balance sheets.

These arrangements are generally structured as strategic investments that align with long-term business goals, rather than as accounting constructs designed to inflate near-term growth.

That said, any material slowdown in AI-related capital expenditures would be a legitimate concern and could introduce volatility, much like the DeepSeek event in January. However, as of now, we see no such signs in the data we monitor. Capital spending, order backlogs and utilization rates across the sector remain healthy and resilient, reinforcing our view that this investment cycle is rooted in real demand rather than speculative excess.

Valuations: Elevated but justified

Valuation remains one of the three core pillars of our investment process: Fundamentals, Valuations and Technicals (the FVTs), so it’s always top of mind.

On balance, we’d rate current valuations as neutral to slightly negative. At first glance, multiples appear high relative to long-term averages. However, when placed in context against record profitability, rising returns on equity and solid earnings growth expectations, we find justification for these elevated levels.

Although we’re still early in earnings season for the third quarter (with 64% of S&P 500 companies reporting actual results), 83% have reported earnings per share (EPS) results above expectations, with year-over-year earnings growth of 10.7% according to FactSet.3 Those figures underscore that today’s valuations are supported by strong fundamentals, not speculative excess.

As we’ve written in prior commentaries, valuation alone is a poor timing tool, particularly when the fundamental and technical trends remain as constructive as they are today.

Closing thoughts

As we move into the final stretch of the year, the market continues to remind us that periods of volatility and uncertainty often accompany strong advances. October’s swirl of policy headlines, labor data ambiguity and valuation debates all contributed to short-term chop. However, the underlying fundamentals, growth, profitability and innovation, remain resilient.

Our Clear Air Turbulence theme continues to ring true: occasional air pockets, yes; but no signs of engine failure. The economy remains on solid footing, corporate America is delivering strong earnings and the Federal Reserve appears to be threading the needle between caution and support.

Investors should remember that market volatility rarely lasts as long as it feels and often sets the stage for renewed strength ahead. While headlines may continue to test conviction, we believe the flight path remains steady, supported by robust fundamentals and a data-driven Fed.

In our view, this remains an environment to hold your ground, stay diversified and keep focused on the horizon rather than the daily air pockets. As we’ve seen time and again, those who stay buckled in during turbulence are often the first to enjoy smoother skies ahead.

Sources:

1Bureau of Labor Statistics

2https://adpemploymentreport.com/

3FactSet Earnings Insight as of 10-31-2025

This commentary is provided for informational and educational purposes only. As such, the information contained herein is not intended and should not be construed as individualized advice or recommendation of any kind.

The opinions and forward-looking statements expressed herein are not guarantees of any future performance and actual results or developments may differ materially from those projected. The information provided herein is believed to be reliable, but we do not guarantee accuracy, timeliness, or completeness. It is provided “as is” without any express or implied warranties.

Equity securities are subject to price fluctuation and investments made in small and mid-cap companies generally involve a higher degree of risk and volatility than investments in large-cap companies. International securities are generally subject to increased risks, including currency fluctuations and social, economic, and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

Fixed-income securities are subject to loss of principal during periods of rising interest rates and are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors before investing. Interest rates and bond prices tend to move in opposite directions. When interest rates fall, bond prices typically rise, and conversely, when interest rates rise, bond prices typically fall.

There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results, and nothing herein should be interpreted as an indication of future performance. Please consult your financial professional before making any investment or financial decisions.

Indexes referenced are unmanaged and cannot be directly invested in. For index definitions visit https://www.marinerwealthadvisors.com/index-definitions/.

Investment advisory services are offered through Investment Adviser Representatives (“IARs”) registered with Mariner Independent Advisor Network (“MIAN”) or Mariner Platform Solutions (“MPS”), each an SEC registered investment adviser. These IARs generally have their own business entities with trade names, logos, and websites that they use in marketing the services they provide through the Firm. Such business entities are generally owned by one or more IARs of the Firm, not the Firm itself. For additional information about MIAN or MPS, including fees and services, please contact MIAN/MPS or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Registration of an investment adviser does not imply a certain level of skill or training.

Material prepared by MIAN and MPS.